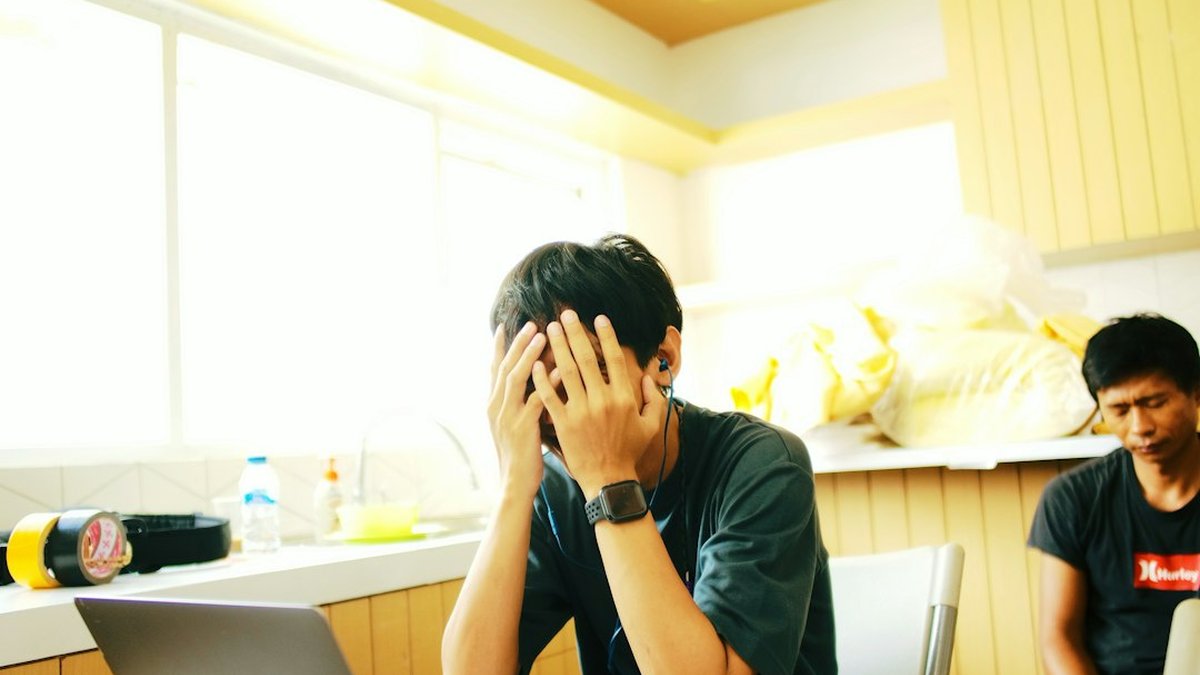

Are setbacks, pivots or investor rejections draining motivation and clarity? This guide provides a practical, evidence-based roadmap for Emotional Resilience for Entrepreneurs Facing Failure: rapid assessment, a step-by-step recovery plan, communication templates and measurable trackers to rebuild momentum.

Key takeaways: what to know in 1 minute

- Emotional resilience is a skill, not a trait — it can be trained using deliberate routines and cognitive strategies.

- Short, measurable actions repair motivation faster than grand plans — use a 14-day micro-routine to restore momentum.

- Reframing failure reduces rumination and preserves confidence — apply structured post-mortem templates and communication scripts to regain control.

- Investor rejection requires a distinct coping set — separate emotional processing from pragmatic next steps and communication to stakeholders.

- Beginner entrepreneurs need different pacing — prioritize capacity management and micro-goals over aggressive rebound strategies.

Why emotional resilience matters for entrepreneurs facing failure

Emotional resilience determines how quickly a founder regains clear decision-making, re-engages the team and pivots without burnout. Research in entrepreneurial psychology links resilience with better learning from failure and improved long-term venture outcomes (Kauffman Foundation). Short-term emotional collapse commonly causes poor communication, rushed pivots and missed learning opportunities. This section focuses exclusively on practical recovery for entrepreneurs who have just experienced a setback.

Simple guide to emotional resilience for entrepreneurs

Core framework: Assess, Process, Rebuild

- Assess: rapid timeline and emotional audit to locate immediate risks (team morale, cash runway, legal liabilities).

- Process: containment activities (brief grounding practices, peer disclosure, safe debrief) to reduce escalation of stress.

- Rebuild: structured micro-tasks, decision boundaries, and measurable KPIs to restore mastery and momentum.

Quick assessment checklist

- Cash runway remaining (weeks)

- Team stability: who is leaving or at risk

- Customer commitments or refunds due

- Investor obligations and communications

- Personal health indicators (sleep < 6 hours, appetite, concentration)

Evidence-based resilience tactics

- Cognitive reappraisal: label the setback, separate identity from outcome. Supported by experimental emotion-regulation studies (American Psychological Association).

- Behavioral activation: schedule short wins (30–90 minute work blocks) that rebuild skill confidence.

- Social calibration: disclose to a trusted peer or mentor within 48 hours to reduce isolation.

Step by step recovering motivation after failure

- Pause notifications for 12–24 hours to avoid reactive escalation.

- Use a simple breathing protocol: 4-4-6 (inhale 4s, hold 4s, exhale 6s) for five minutes, three times a day.

- Inform core stakeholders with a short, factual message (template provided below).

Step 2: 14-day micro-routine to rebuild momentum

- Day 1–3: focus on health metrics (sleep, hydration, 20-minute walk daily).

- Day 4–7: perform three 60–90 minute small-win sprints (customer outreach, bug fixes, pitch edits).

- Day 8–14: run a measurable experiment tied to learning (e.g., validate one new channel, interview five users, reduce burn by 10%).

Metrics: daily mood score (1–10), number of small wins, minutes focused per day. Track in a simple spreadsheet or habit app.

Step 3: structured post-mortem (48–96 hours after initial stabilizing)

- Use a fixed template: Goal, What happened, Contributing factors (internal/external), What was learned, Concrete next experiment (with timeline).

- Avoid blame language; record evidence and decisions.

Step 4: rebuild confidence via progressive exposure

- Start with low-risk public actions: social proof posts, share lessons learned with founder groups, or publish a short post describing the pivot rationale.

- Gradually increase stakes: draft a new pitch, re-engage an investor only after three validated micro-experiments.

How to rebuild motivation after pivot

Reframing the pivot as learning-first

- Replace outcome language (“failed product”) with learning language (“this experiment showed X about customer behavior”).

- Quantify what changed: conversion rates, churn, feature usage. Numbers neutralize overgeneralized failure narratives.

Tactical plan for a pivot recovery (30/60/90 days)

- 0–30 days: validate assumptions that informed the pivot; talk to 15 customers, run 3 low-cost experiments.

- 31–60 days: build an MVP or a landing page and test conversion; set a success threshold (e.g., 5% conversion or 20 qualified leads).

- 61–90 days: decide to scale or iterate based on pre-defined KPIs.

Communication template for announcing a pivot to team and investors

- Short subject line: "Update: strategic pivot and next steps"

- Paragraph 1: one-sentence reason and learning.

- Paragraph 2: immediate actions and owner names.

- Paragraph 3: timeline and how progress will be measured.

Use factual, measured language and include a concrete date for the next update.

Best coping strategies after investor rejection

Separate emotional processing from tactical response

- Emotional processing: schedule one 30–60 minute session to journal or speak with a mentor; allow the emotional reaction without making decisions.

- Tactical response: after that window, conduct a pragmatic review of investor feedback and map which points to address.

Investor rejection playbook

- Record the exact feedback given and timestamp it.

- Score feedback for signal vs. noise: which items are repeatable across investors?

- Prioritize changes that can be validated in 14–30 days.

- Create a shortlist of 5 new targets and tailor messages based on learning.

Coping strategies that reduce downstream harm

- Peer debriefs with other founders reduce rumination and normalize rejection experiences (APA).

- Cognitive distancing: write the current status as if it happened to a colleague; this increases objectivity.

- Ritualized resets: a short, symbolic act (e.g., clearing a workspace) signals transition from processing to rebuilding.

Emotional resilience strategies for beginner entrepreneurs

Prioritize capacity and slow scaling

- Beginner founders often overcommit. Treat resilience as capacity management: set conservative burn and staffing plans.

- Use micro-goals (weekly) instead of large milestone pressure. This reduces fear of failure and preserves iteration cycles.

Simple daily routine for emotional steadiness

- Morning: 10-minute planning and one prioritized task.

- Midday: 20-minute walk or movement.

- End of day: 10-minute reflection (what worked, what to change).

Mentorship and community scaffolding

- Join a peer cohort or founder group; commit to one hour per week of mutual case review.

- If mentorship access is limited, schedule monthly office hours with an advisor and prepare one clear question.

Practical templates and trackers included

Post-mortem template (copyable)

- Goal: [one-sentence]

- Outcome: [what happened, numbers]

- Contributing factors: internal / external

- Key learning: [3 bullets]

- Next experiment: [hypothesis, metric, timeline]

14-day micro-routine tracker (columns)

| Day |

Focus area |

Small win (Y/N) |

Mood (1-10) |

Minutes focused |

| 1 |

Health reset |

Y |

6 |

45 |

| 7 |

User interviews |

Y |

7 |

120 |

| 14 |

Experiment result |

N |

6 |

90 |

Comparative table: coping after investor rejection vs. general failure

| Area |

Investor rejection |

General product/market failure |

| Emotional timeline |

Short, intense sting tied to identity |

Ongoing erosion tied to metrics |

| Primary task |

Reframe feedback, identify new leads |

Validate hypotheses, rebuild product-market fit |

| Communication |

External-facing (investors, press) |

Internal and customer-facing |

| Best immediate tactic |

Log feedback, pause fundraising |

Run rapid experiments |

| Risk if mishandled |

Reputation signal loss |

Extended cash burn |

14-day recovery flow for entrepreneurs

14-day recovery flow for entrepreneurs

1️⃣

Days 1–3: Contain

Pause, breathe, inform core stakeholders, sleep and hydrate

2️⃣

Days 4–7: Activate

Small-win sprints, five user calls, one quick experiment

3️⃣

Days 8–14: Validate

Measure outcomes, adjust pivot or scale plan, prepare next investor touchpoint

✅

Outcome

Clear decision: iterate, pivot or pause, based on pre-defined KPIs

Advantages, risks and common errors

Benefits / when to apply ✅

- Apply when motivation is low but runway exists: the 14-day routine restores momentum with minimal risk.

- Use when feedback is ambiguous: structured post-mortems convert noise into testable hypotheses.

- Implement for early-stage founders who need to preserve learning capacity.

Errors to avoid / risks ⚠️

- Rushing fundraising immediately after rejection without digesting feedback.

- Turning narrative of failure into global identity statements ("I'm a failure").

- Over-indexing on grand pivots before validating one or two micro-experiments.

Frequently asked questions

How long does emotional recovery usually take for a founder?

Recovery varies, but the suggested micro-routine aims for measurable improvement in 14 days and clearer decisions by 30–90 days.

A short, factual follow-up thanking the investor, asking for clarifying feedback and requesting permission to keep them updated on progress.

Can resilience be learned quickly?

Yes. Short, repeated practices—cognitive reappraisal, behavioral activation and social disclosure—produce measurable resilience gains over weeks (NCBI review).

Should the founder tell the team about the rejection?

Transparency is context-dependent. Share high-level facts and a clear plan to avoid rumor and preserve morale.

How to measure progress in emotional recovery?

Track mood (1–10), number of small wins per week, minutes of focused work, and one experiment metric (conversion, interviews completed).

Your next step:

- Complete the 48-hour containment actions: pause outreach, breathe exercises, and send a short stakeholder update.

- Start the 14-day micro-routine and log daily mood, one small win and minutes focused.

- Run one rapid experiment with a clear success threshold and a 14–30 day timeline.